Life Insurance - Truths

Table of Contents8 Easy Facts About Life Insurance ShownGetting The Life Insurance To WorkIndicators on Life Insurance You Need To KnowSome Ideas on Life Insurance You Need To KnowThe smart Trick of Life Insurance That Nobody is Talking AboutThe 8-Minute Rule for Life InsuranceThe Life Insurance StatementsThe Ultimate Guide To Life Insurance

Life insurance policy is there to assist take a few of the monetary problem off your liked ones when you pass. It does not take long to discover a life insurance policy plan that will certainly meet your demands and help your family members when they need it most. WEB.1893 (life insurance). 02.16.

Life Insurance for Beginners

Costs and also various other plan attributes can vary by several variables including the quantity of coverage you require, in addition to your age and also health. If fatality occurs while the insurance coverage is active, your recipients can send a case to get the payment.

"We normally recommend individuals go for 10 to 15 times their earnings in life insurance policy," states Nicholas Mancuso, elderly operations manager of Policygenius' innovative planning group. This quantity guarantees your beneficiaries are covered for the lengthy term. Since a life insurance policy benefit is a tax-free lump sum of cash, your family can make use of the cash money nevertheless they want, consisting of: Housing costs, including paying off a home loan or paying lease, Various other financial obligations, like trainee lendings, credit history cards or cars and truck payments, Existing or future college education and learning costs for your youngsters, Child care Changing financial backing you supplied, Daily expenses consisting of food, transport and healthcare, Vacation There are several kinds of life insurance policy, yet term life insurance policy is the very best choice for most individuals because it is the most economical.

The Buzz on Life Insurance

The advantages of a term life plan include: The least expensive life insurance coverage you can acquire. If you get term life insurance policy when you're in your 20s, 30s, or 40s, you can secure in low rates.Term life insurance policy is simply an insurance coverage product and doesn't have a cost savings or investment component. This is an advantage investing as well as saving on your own yields greater returns.

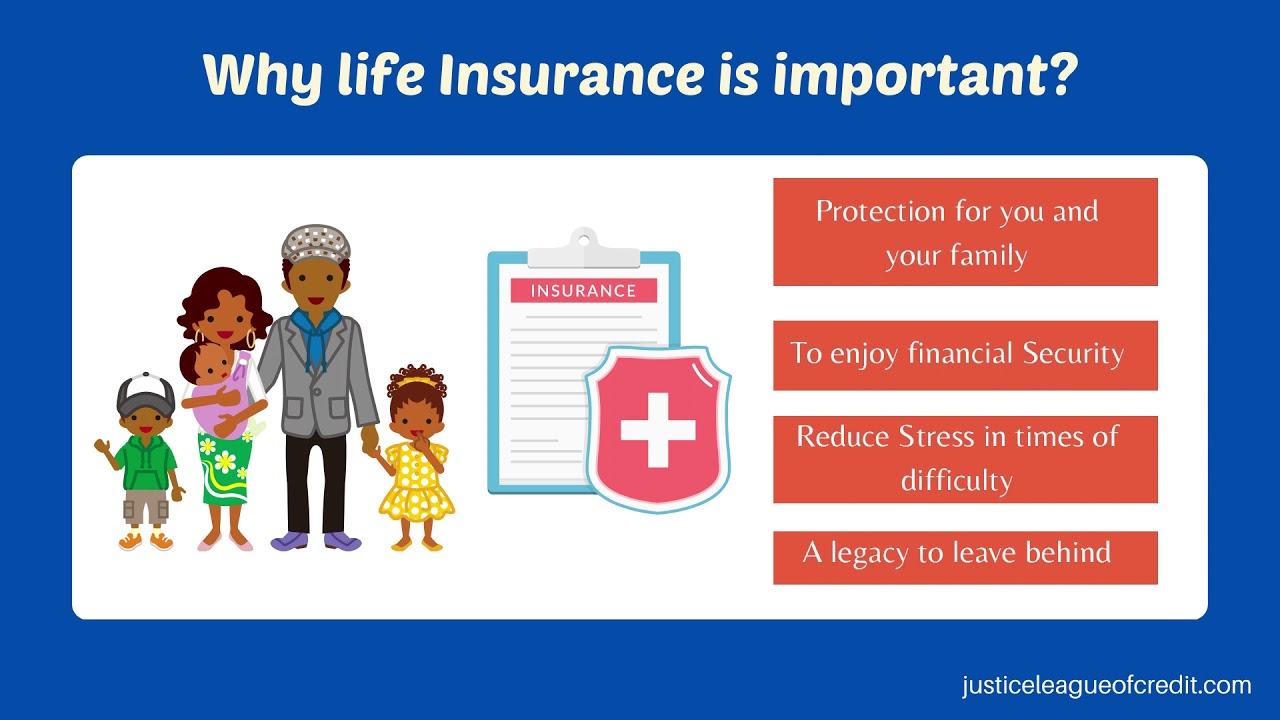

The most noticeable benefit of life insurance policy is the tax-free cash money payout for your liked ones if you pass away. Monetary defense is one of the most essential property life insurance policy attends to you and also your household. Yet there are other major benefits, relying on the sort of life insurance coverage policy you acquire and which extra motorcyclists you select.

6 Simple Techniques For Life Insurance

What are the benefits and drawbacks of life insurance? The biggest benefit of life insurance is economic protection for your enjoyed ones if you die. Nevertheless, you do have to pay regular monthly costs for this comfort, which can be pricey if you're in inadequate wellness or buying protection when you're older.

This write-up has to do with enhancing awareness regarding the importance of getting life insurance policy in the post-covid-19 pandemic period. Complying with are some factors that will certainly assist you get the relevance of life insurance policy: People have actually ended up being a lot more familiar with their wellness standing and have become aware life insurance importance and also advantages.

The Life Insurance Diaries

Have you assumed of spending your hard-earned cash as well as letting it grow as well as insuring your household at the same time? Having actually invested in a life insurance coverage plan gives you with twin chances of guaranteeing your family and also spending your money in the market in shares, bonds, stocks, etc.

One of the most vital aspects of life insurance policy importance is that it offers a monetary roofing system on your family members in case of any regrettable mishap as well as uncertain times, such as the death of the family members's get redirected here income producer. In such instances, you wouldn't need to fret if your family will deal with any type of monetary restraints in your absence.

Not known Incorrect Statements About Life Insurance

In instance of an unfavorable event of fatality of the investor, their Click This Link family members will obtain a lump sum amount of money in the type of fatality advantages. Therefore, even if you are the single income producer of your family, you would not need to stress over your household's economic requirements.

1. 5 lakhs yearly.

All About Life Insurance

Several years ago, at our annual business banquet, we had a guest speaker. She was a client of Finity Group (as well as still is today).

The smart Trick of Life Insurance That Nobody is Talking About

She wasn't even sure just how she was going to obtain with her maternity, allow alone bring on with life as a solitary mom. Clearly having article source life insurance coverage would not have actually brought her hubby back, but it would have eased some of the financial stress and anxieties she dealt with throughout that time.